Finally, weŌĆÖre headlong into 2021 with vaccines, tea at Nkandla, Bitcoin and Biden making up most of the headlines so far this year.

Markets have made a comeback over the last three months with the introduction of vaccines worldwide, and hopefully the sentiment can stay with us for a while.

In this newsletter we will be discussing the following:

Ō¢¬ The market update for January/February (Contributions from Glacier & Laurium Capital)

Ō¢¬ The latest news on the retirement reform changes to Provident Funds, being implemented 1 March 2021. (Contributions from Sanlam Employee Benefits)

Ō¢¬ Important information on tax season ŌĆō time is running out for additional contributions for the 2021 tax season

Ō¢¬ Short term insurance ŌĆō Understanding subrogation and your responsibility when dealing with claims.

Ō¢¬┬ĀThe market update for January/February (Contributions from Glacier & Laurium Capital)

Ō¢¬┬ĀThe latest news on the retirement reform changes to Provident Funds, being implemented 1 March 2021. (Contributions from Sanlam Employee Benefits)

Ō¢¬┬ĀImportant information on tax season ŌĆō time is running out for additional contributions for the 2021 tax season

Ō¢¬┬ĀShort term insurance ŌĆō Understanding subrogation and your responsibility when dealing with claims.

Market Overview

January saw divergent performance for shares, with developed market equities ending the month lower while emerging market equities posted positive returns. The solid gains during the end of 2020 seemed to carry through to the start of 2021, with the first week of January showing major markets all in positive territory year to date (YTD) as the US extended its bull run. However, by the second week of the month we saw markets move to a downward trend and, with a lot of good news already priced in, the month ended on a slightly more somber note relative to its start. While positive sentiment around the various COVID-19 vaccine rollout projects initially lifted share prices, there have been ongoing concerns about the pace of global vaccine roll-outs, the level of supply, as well as its effectiveness due to the emergence of the various new COVID-19 variants. Enduring lockdowns in the UK and parts of Europe added to these concerns.

The relatively slow roll-out of Covid-19 vaccines led the headlines in Europe. Also knocking sentiment was political turmoil in Italy that led to the resignation of Prime Minister Conte. The European CommissionŌĆÖs consumer confidence survey fell by 1.7 points compared to December. In the UK, the roll-out of vaccines gained momentum but lockdown restrictions weighed on economic activity. The composite purchasing managersŌĆÖ index, a measure of service and manufacturing sector activity, fell to 40.6 in January from 50.4 in December (a reading below 50 indicates contraction).

China released its 2020 GDP figures. Its full-year growth came in at 2.3% year-on-year (y/y) in real terms excluding price fluctuations. Even though positive growth during a world pandemic is admirable, this is ChinaŌĆÖs lowest growth figure since 1976.

Locally, President RamaphosaŌĆÖs State of the Nations Address shows the usual promises in infrastructure plans, job creation and anti-corruption. As expected most commentators feel that the speech was a re-hash of previous promises that have gone undelivered for years under ANC leadership. But there was one new item that left a glimmer of hope – the Electricity Regulation Act will be amended in the next 3 weeks to allow private generation capacity of up to 50MW without needing a license, a significant increase from the current 1MW limit. This will reportedly unlock 5000MW in production and ease the strain on our power grid. Although experts say it might take more time to implement, we truly hope that this will reduce the loadshedding sooner rather than later.

Looking at the RSA market, the Covid caseload thankfully responded to the level 3 lockdown measures and declined. Nonetheless, a bungled vaccine procurement process and rollout plan kept domestic stocks in check. The SA equity market however rallied quite strongly by 5.2% for January, rather rhyming with emerging markets which in general had a better month than developed markets.

The big winners were Naspers (driven by a 20% surge in Tencent) and the resource/mining stocks in January. This trend has been carried into February with markets performing well thus far. Hopefully 2021 will be a year of good returns as production in the rest of the world will start to pick up post the big vaccine roll-outs.

Talking about vaccines ŌĆō there have been lost of discussions around whether or not you should get it, who will have access to it in RSA, etc. Johnson & Johnson released the results of their Phase 3 Covid-19 vaccine trial. The vaccine results indicated that it was 72% effective in the United States but only 57% effective in South Africa. The difference in efficacy is likely due to the South African strain. 57% efficacy implies that out of 100 people who are vaccinated, 57 will not get the disease. However, it is not all bad news. The vaccine reduced hospitalisations and deaths by 100%. While some people will still get Covid-19 after taking the vaccine, the severity of the disease will be much less.

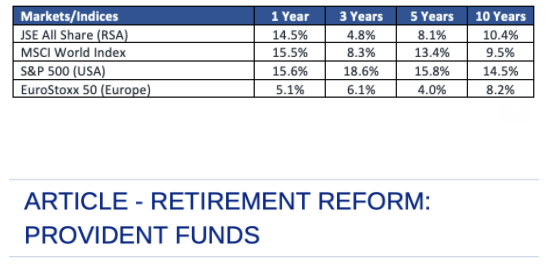

Market Indicators

Looking at the impact of the COVID-1 pandemic and the recovery afterwards, these were the market returns over the last year:

RETIREMENT REFORM ŌĆō CHANGES TO PROVIDENT FUNDS

Over the last few years, government has been reviewing and changing the laws that control the retirement fund industry. These retirement reforms aim to ensure that you save enough for retirement and that your savings are protected. Certain changes, that would have happened in March 2015, are now becoming effective on

1 March 2021. These are referred to as ŌĆ£T-DayŌĆØ.

HOW DOES IT AFFECT YOU

T-day rules only apply to how your retirement benefits under provident funds or provident preservation funds are paid. Pension funds and pension preservation funds are unaffected.

Nothing changes when you withdraw before retirement ŌĆō you can still take all your savings in cash and the withdrawal will still be heavily taxed.

From 1 March 2021, retirement benefits from provident funds / provident preservation funds will have the same rules as pension funds, where you can only withdraw one third of the fund value at retirement and re-invest the balance for annuity income in retirement.

VERY IMPORTANT – If you are 55 years or older on 1 March 2021, you will not be affected by any of these new rules ŌĆō as long as you stay in the same provident / provident preservation fund.

For any provident fund members younger than age 55, your fund value will consist of two portions from 1 March 2021: Vested member share & Non-vested member share.

Vested Member Share

ŌĆó All your savings as at 28 February 2021 (plus interest thereon) will be in this portion.

ŌĆó You may take this portion in cash when you retire (100% accessibility).

Non-vested Member Share

ŌĆó All your savings from 1 March 2021 (and interest thereon) will be in this portion.

ŌĆó If this portion is R247 500 or less, you may take this portion in cash when you retire.

ŌĆó If this portion is more than R247 500, you may only take one-third of this in cash and you must use the other two-thirds to receive retirement income (through a Living Annuity or Life Annuity)

Please let us know if you have any other questions on the changes.

As we approach the end of the tax season on 28 February 2021, itŌĆÖs important to maximise the tax benefits available on your retirement annuity (RA) & Tax-free Investment. The more you save towards retirement, the less tax you pay.

RETIREMENT ANNUITIES

If you have a lump sum of money available to top up your RA before 28 February, you can increase your tax benefits for that year.

You can also choose to increase their monthly contributions for the following year, ideally through a debit order. That way the contribution happens automatically, and you arenŌĆÖt tempted to spend the money.

TAX-FREE INVESTMENTS

If youŌĆÖve taken advantage of all the tax benefits available through retirement annuity contributions, consider a tax-free investment that can help you reap even more tax benefits and bolster retirement savings.

Offering an investment option with zero tax on investment income or growth and no Dividend Withholding Tax (DWT), you can invest up to R36000 per tax year until you reach the lifetime limit of R500 000.

If you do have an additional lump sum available for saving, please contact us, as we only have two weeks left before ethe end of the tax year.

ŌĆ£ŌĆ”The insured may not proceed against an uninsured third party in his own capacity as this will prejudice the insurerŌĆÖs rights to continue with the subrogation processŌĆ”ŌĆØ

It is a reality that due to the high number of accidents on our roads the average South African will at one time or another deal with the insurance claim procedure and undoubtedly be confronted with the term ŌĆ£subrogationŌĆØ.

Subrogation can be defined as a right that allows one party, normally an insurance company, to step in the shoes of another, the insured, and proceed with legal steps against the negligent third party that was responsible for the damages suffered by the insured.

Subrogation is one of the ways in which insurance companies recover monies that were paid out to the party insured by them.

An example of a case of subrogation is as follows: Driver A collides into the rear of your motor vehicle and causes damages to your motor vehicle. You have a valid insurance policy and your insurance company pays for the damages caused to your motor vehicle. Your insurance company will then have the right to claim the amount paid to you, from Driver A. The insurance company is thus ŌĆ£subrogatedŌĆØ to the rights of your policy and can ŌĆ£step in your shoesŌĆØ to recover any amount paid out to you.

Subrogation goes hand in hand with the principles of indemnity, and the primary purpose of subrogation is to prevent the insured from receiving compensation from both the insurer and the negligent third party.

How Subrogation Works

Subrogation is generally the last part of the insurance claims process. In most cases, the insured hears little about it and is only confronted with it once the insurance company proceeds with a claim against the negligent third party.

If an insurance company does decide to pursue subrogation, it has to inform the insurer of their intention to proceed with legal steps against the third party. This is important to you as policy holder since if the insurance company proceeds with legal steps against the third party, they also attempt to recover the cost of your deductible/s, and refund it to you once they recover it. These deductibles would in most cases be your excesses or damages not covered by the insurance policy.

How does the process work?

Once you lodge a claim with the insurance company and it is determined that another driver or party is at fault, the insurance company will generally pay the claim or repair the damages to your vehicle.

The insurance company will then seek to recover all the money or at least a part of it paid to you from the negligent party that caused the accident.

It is important to note that the insurance contract often places an obligation on the insured to co-operate with the insurer during the recovery process. This assistance might entail that the insured would have to attend court to give evidence on how the collision occurred.

Requirements for Subrogation

Valid insurance contract

Since an insurerŌĆÖs right to subrogation is derived from the contract of insurance, no subrogation can take place where an insurer has paid out monies in terms of an invalid insurance contract

InsuredŌĆÖs loss must have been fully compensated

Often an insurance contract does not fully protect an insured in respect of his damages. There may be an excess payable or the sum insured may be insufficient. The insurer must first fully compensate the insured before the insurer can lay claim to the monies received by the insured from the third party.

The Right must be susceptible of subrogation

An insurer can only claim subrogation from the third party if the insured have a right against the third party.

Duties of the insurer under subrogation

It is the duty of the insurer who is dominus litis not to prejudice the position of the insured for example an unfavourable settlement.

Further since the insurer merely represents the insured in the proceedings against the third party and acts in the insuredŌĆÖs name, any legal cost or cost awarded in favour of the third party must be borne by the insurer.

The insurerŌĆÖs right to subrogate can only be enforced against the insured. Both the insured and the insurer have reciprocal duties to each other to preserve the insuredŌĆÖs claim against the third party.

VERY IMPORTANT

In terms of most of the insurance policies the insured is specifically prevented from compromising or prejudicing any claim by:

ŌĆó agreeing to a settlement without the insurerŌĆÖs express authorisation

ŌĆó signing an admission of guild/negligence

ŌĆó to release a third party from any liability.

The insured may not proceed against the third party in his own capacity as this will prejudice the insurerŌĆÖs rights to continue with the subrogation process.

Conclusion

Since an insurance policy is a contract consentingly entered into between the insured and the insurer and as such it is of upmost importance to understand the terms you are binding yourself to.